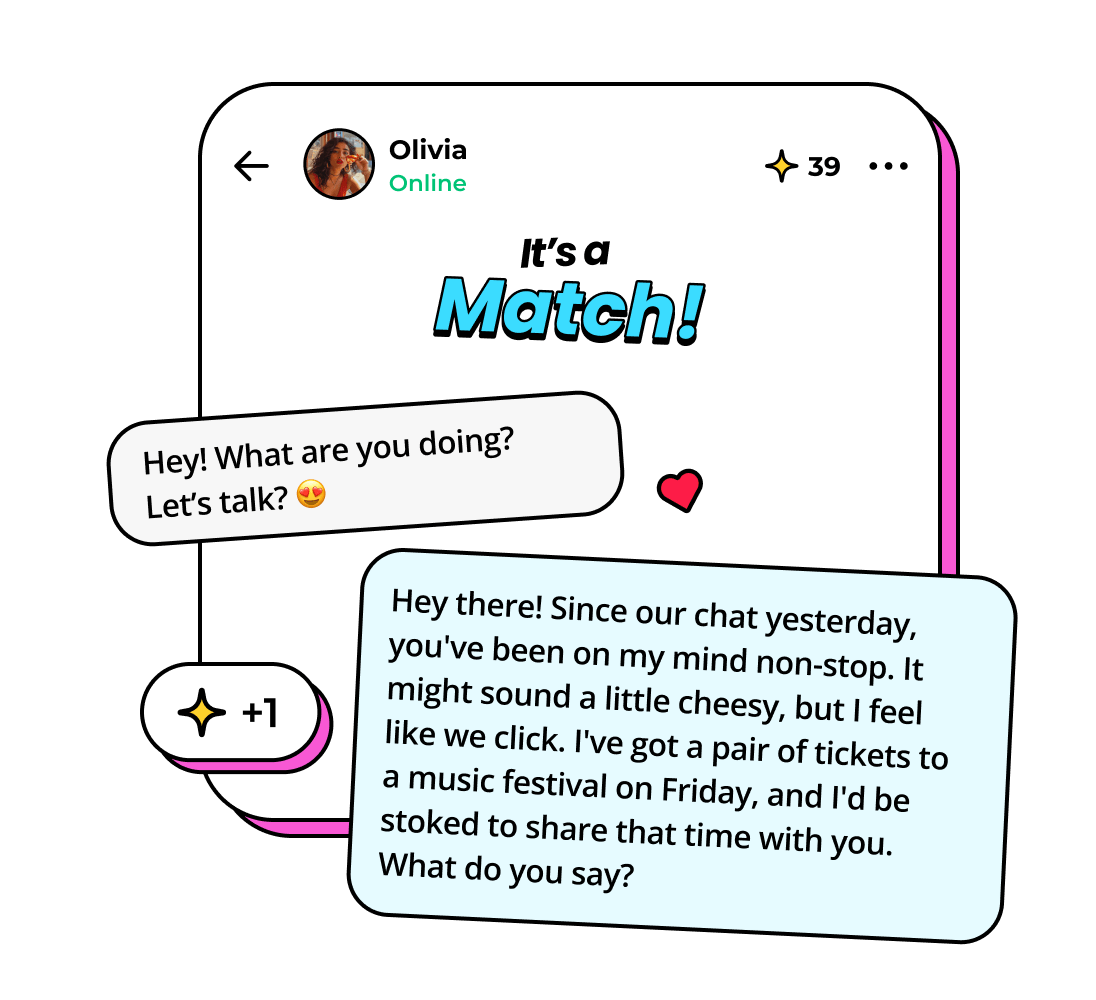

perfect

match

once a day

match

once a day

Get a match every day based on your Vibes!

check

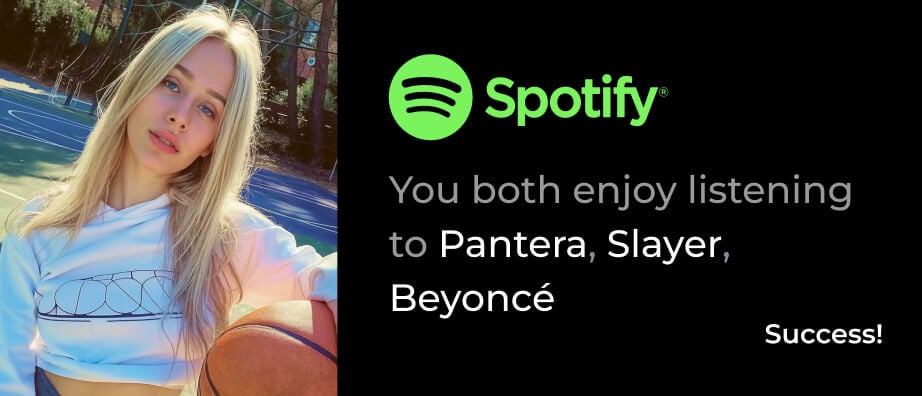

a music

match

a music

match

Find your soulmate via Spotify Match!

people

with

your vibe

with

your vibe

Connect with your vibe tribe!

get

sparks

for love

sparks

for love

Spend it in gifts, chats and more!

our

mission

mission